Understanding the Impact of Fed’s Recent Interest Rate Decisions on Small Business Loans and How Alternative Lending Solutions Like MCAs Can Bridge the Gap

Estimated reading time: 7 minutes

- Learn about the effects of rising interest rates on small business loans.

- Explore how alternative lending solutions, such as MCAs, are gaining popularity.

- Understand the implications of the Fed’s decisions for borrowing costs.

- Get practical takeaways for navigating the current lending landscape.

Table of Contents

- The Fed’s Interest Rate Landscape

- Effects on Small Business Loans

- The Rise of Alternative Lending Solutions

- What Are Merchant Cash Advances?

- How the Fed’s Decisions Affect MCAs

- Practical Takeaways for Business Owners Exploring Financing

- Conclusion: Bridging Gaps with Big Think Capital

- FAQ

The Fed’s Interest Rate Landscape

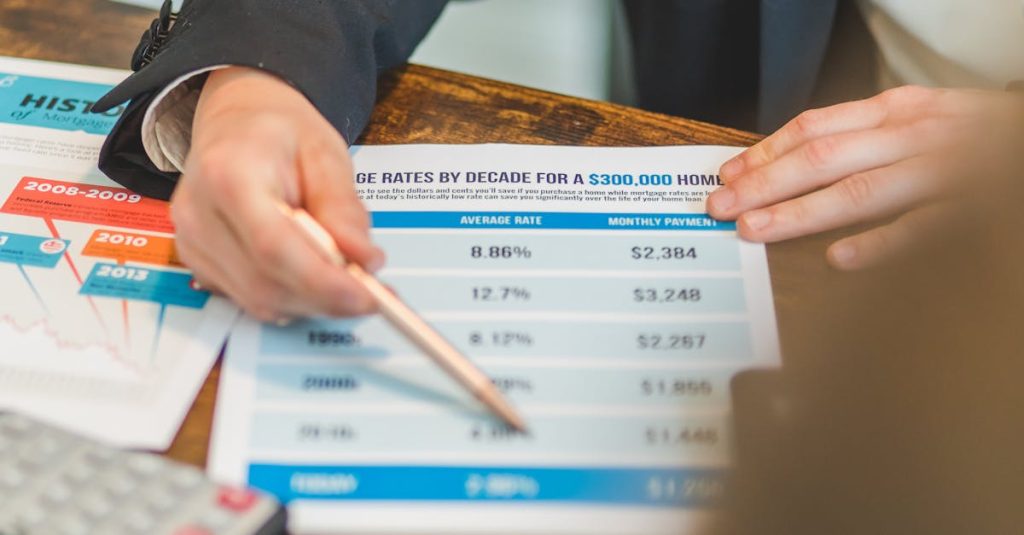

The Federal Reserve (Fed) is tasked with managing monetary policy, which directly influences interest rates across the economy. In 2025, the Fed’s approach remains pivotal for funding availability. With inflation still a concern in our economy, the Fed has shifted interest rates significantly over the past few years. In 2022 and 2023, the Fed raised rates aggressively to combat inflation, leading to higher borrowing costs. However, as inflation shows signs of stabilization, the Fed may adopt a more cautious approach in the coming year.

According to the Fed, the goal is to strike a balance between encouraging economic growth and controlling inflation. In resolving this ongoing challenge, small business loans have seen varying adjustments that will impact access to funding.

Effects on Small Business Loans

As interest rates rise, the cost of borrowing generally follows. This directly influences the options available to small businesses:

- Higher Loan Costs: Traditional small business loans that once offered low-interest rates now come with significantly higher costs. The average rate for a small business loan has spiked to around 9.4% as of 2025, according to the National Federation of Independent Business (NFIB).

- Stringent Approval Criteria: With increasing rates, lenders may tighten their lending criteria, making it more challenging for small businesses to qualify for funding. This is especially true for startups or businesses with limited credit history.

- Shift to Alternative Lending: As traditional lending becomes less accessible, many businesses are turning to alternative lending solutions to secure necessary funding.

The Rise of Alternative Lending Solutions

Pooling resources from various sectors of the economy, alternative lending has surged become a preferred option for many small business owners. This sector encompasses various financial products, including working capital advances, equipment financing, merchant cash advances (MCA), and lines of credit.

What Are Merchant Cash Advances?

A merchant cash advance (MCA) is a lump sum payment made to a business in exchange for a portion of future credit card sales. This option is particularly attractive to businesses that process significant credit card transactions, such as retail stores and restaurants.

Here’s why MCAs are gaining traction:

- Speed of Funding: MCA providers often provide funding in a matter of days, compared to weeks or months for traditional loans.

- Flexible Repayment Options: Since repayments are tied to credit card sales, businesses only pay back when they make sales, providing a cushion during slow days.

- Less Stringent Requirements: Many MCA providers focus more on cash flow rather than credit scores, allowing businesses with a less favorable credit history to secure funding.

How the Fed’s Decisions Affect MCAs

While alternative lending solutions like MCAs can fill gaps in funding access, they too are not immune to the Fed’s interest rate policies. Here are important considerations for business owners:

- Cost of MCAs: While easier to obtain, MCAs can carry higher effective interest rates than traditional loans. As the Fed raises rates, MCA providers may adjust their fees accordingly.

- Market Competition: A higher borrowing cost may push traditional lenders out of the market, allowing MCA providers to take on more business. As demand increases, the terms of such offers may evolve, potentially leading to more attractive options for business owners.

- Strategic Funding Planning: Businesses should evaluate their cash flow needs and business cycles when considering an MCA. Understanding the payment structure and how it aligns with revenue can help ensure that the solution remains viable during both high and low sales periods.

Practical Takeaways for Business Owners Exploring Financing

Navigating the current lending landscape can be daunting. Here are three practical takeaways that small business owners should keep in mind:

- Stay Informed on Rate Changes: With the Fed actively manipulating interest rates, staying informed can help you time your funding needs better. Monitoring economic indicators and Fed announcements can help you make more strategic decisions.

- Evaluate All Financing Options: Don’t limit yourself to traditional loans. Understand what alternative lending products are available and how they align with your business needs. MCAs could be a viable option if you rely heavily on credit card sales.

- Plan for Cash Flow Variability: A solid understanding of your business’s cash flow can facilitate better planning for financing needs. Consider utilizing SMEs (small and medium enterprises) financial advisors to create a roadmap tailored to your unique situation.

Conclusion: Bridging Gaps with Big Think Capital

As we venture deeper into 2025, the impact of the Fed’s interest rate decisions on small business lending will only grow. Understanding these shifts is paramount for small business owners wanting to secure funding. While the road may become more challenging, alternative lending solutions like merchant cash advances present a flexible and timely option for accessing capital.

At Big Think Capital, we are dedicated to helping small businesses navigate their financing options, providing insight and expertise to secure the funding necessary for growth. By offering a diverse range of lending solutions, including working capital advances and MCA, we work diligently to bridge the gap between small businesses and the capital they need.

Are you looking to explore your financing options in light of recent economic changes? Visit us at bigthinkcapital.com to learn more or speak with one of our funding experts today. Let us help you unlock the potential of your business with the right financing solution tailored to your needs.

Frequently Asked Questions (FAQ)

Q1: What impact do interest rate changes have on small business loans?

Interest rate changes can significantly increase the cost of borrowing, making it more challenging for small businesses to secure funding as lenders adjust their pricing and criteria in response to the Fed’s decisions.

Q2: Are alternative lending solutions reliable?

Alternative lending solutions, such as MCAs, provide faster access to funds and may offer more flexible repayment terms than traditional loans, making them a viable option for many businesses.

Q3: How can I determine if an MCA is suitable for my business?

Assess your cash flow patterns and business needs. If your sales fluctuate and you rely heavily on credit card transactions, an MCA might provide the necessary flexibility.