Understanding the Influence of Fed Interest Rate Decisions on Small Business Loans: A Comprehensive Guide for Small Business Owners

Estimated reading time: 5 minutes

- Understand the Fed’s influence on loan costs.

- Learn how to time your loan applications.

- Evaluate the risks between fixed and variable loan rates.

Table of Contents

- Understanding the Federal Reserve’s Role

- How Interest Rates Impact Small Business Loans

- Current Trends in the Federal Interest Rates

- What This Means for Small Business Owners

- The Case for SBA Loans and Equipment Financing

- Expanding Your Financial Vocabulary: Key Terms to Understand

- Leveraging Big Think Capital’s Expertise

- In Conclusion

- FAQ

Understanding the Federal Reserve’s Role

The Federal Reserve, often referred to as the Fed, serves as the central bank of the United States. One of its primary responsibilities is to manage monetary policy, which includes setting interest rates. By adjusting the federal funds rate, the Fed influences economic activity, impacting inflation rates, employment figures, and ultimately, borrowing costs for consumers and businesses alike.

How Interest Rates Impact Small Business Loans

The relationship between Fed interest rates and small business loans is direct. Here’s how it works:

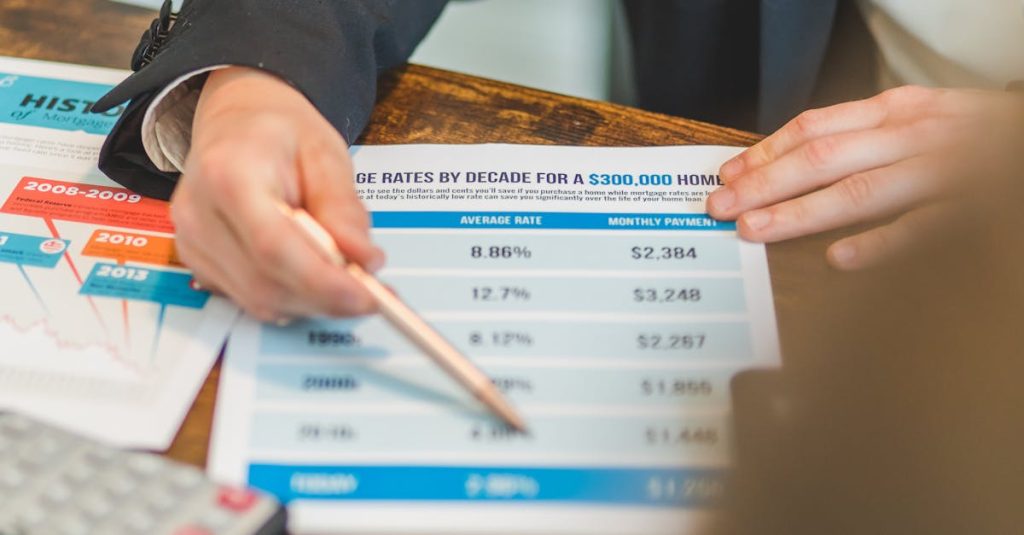

- Cost of Borrowing Increases or Decreases: When the Fed raises interest rates, the cost of borrowing also typically rises. This can lead to higher monthly payments for business loans. Conversely, when rates are lowered, borrowing becomes cheaper, allowing businesses to invest without overextending their budgets.

- Lending Standards Tighten or Loosen: High-interest rates may prompt lenders to adopt tighter lending standards, making it harder for small businesses to qualify for loans. On the other hand, lower rates can encourage lenders to grant loans more freely, benefiting those who might have struggled to meet the criteria under stricter conditions.

- Impact on Loan Products: Various loan products respond differently to interest rate changes. For instance, Small Business Administration (SBA) loans typically have fixed rates, which can insulate borrowers from immediate fluctuations in the market. In contrast, variable-rate loans can lead to costs that fluctuate over the life of the loan.

Current Trends in the Federal Interest Rates

As of 2025, the Federal Reserve has taken a cautious approach to interest rates amidst ongoing economic recovery. After several adjustments over previous years, the rates are currently stable, though future hikes may still be on the table depending on inflation developments.

What This Means for Small Business Owners

Understanding how the Fed’s actions affect your financing options is key. As a small business owner, here are three practical takeaways:

- Timing Your Application Matters: If you are considering applying for a loan, keep an eye on Fed announcements. A preemptive application before a potential rate hike could save you significant money over the life of your loan.

- Explore Alternative Lenders: Beyond traditional banks, alternative lending options, such as working capital advances and merchant cash advances, can provide flexibility. These lenders often take a more holistic view of your business’s performance rather than relying solely on credit scores.

- Consider Fixed vs. Variable Rates: Evaluate your risk tolerance when it comes to loan products. Fixed-rate loans provide stability over time, while variable rates can be lower now but could rise substantially if interest rates climb.

The Case for SBA Loans and Equipment Financing

SBA loans remain a reliable option for many small businesses. With competitive interest rates and extended payment terms, these loans are designed specifically to promote growth and sustainability among small businesses. Currently, the Fed’s stable interest rate environment supports favorable conditions for SBA financing.

Additionally, equipment financing allows businesses to acquire the necessary tools without making large upfront payments. Interest rates on this type of financing can vary, but typically align with overall market conditions set by the Fed.

Expanding Your Financial Vocabulary: Key Terms to Understand

As you navigate the complexities of small business financing, it’s vital to familiarize yourself with certain key terms:

- APY (Annual Percentage Yield): This reflects the total amount of interest paid on a loan or earned on an investment over the course of a year, factoring in compounding.

- Fixed and Variable Rates: A fixed rate stays the same for the life of the loan, while a variable rate can fluctuate based on market conditions.

- Underwriting Standards: These are the criteria lenders use to assess risk and decide whether to approve a loan application.

Leveraging Big Think Capital’s Expertise

At Big Think Capital, we understand that navigating the nuances of interest rates and funding options can be daunting for small business owners. Our team is dedicated to providing tailored solutions that fit your unique financial needs. Whether you’re looking for an SBA loan, equipment financing, a merchant cash advance, or a line of credit, we’re equipped with the tools and expertise to guide you through the process.

In Conclusion

The influence of Federal interest rate decisions on small business loans is a critical aspect of financial planning for owners. By staying informed and adapting to changes in the market, you can position your business for success.

If you’re ready to explore your funding options or if you have questions about how current interest rates might influence your borrowing strategy, we invite you to connect with our funding experts. Discover the financing solutions available to you today by visiting us at bigthinkcapital.com or reaching out directly for personalized assistance.

Your business deserves the right funding at the right time, and we’re here to help you achieve that goal.

FAQ

1. How do interest rates affect my ability to get a loan? Interest rates directly impact the cost of borrowing. Higher rates can lead to increased monthly payments and potentially stricter lending criteria.

2. What is the difference between fixed and variable loan rates? Fixed rates remain constant throughout the life of the loan, while variable rates can fluctuate based on market conditions.

3. Can I qualify for an SBA loan? SBA loans have specific qualification criteria, but they often offer beneficial terms for small businesses.

4. How can I stay updated on Federal interest rate changes? Regularly check the Federal Reserve’s website or subscribe to financial news outlets that report on economic changes.